In the Democratic Republic of Congo, table banking groups encourage women to save money and enable them to take out loans. People who do not have access to traditional banks now are able to access capital. With borrowed capital, many start their own business, which improves livelihoods. For women, table banks allow for financial independence.

Fida workers visited the Democratic Republic of Congo to meet a group called Umoja Ngufu. This is table banking groups name means ‘Strong Unity’. The purpose of the visit was to find out how people who have had to flee their homes due to conflict are benefiting from the table banking program started by Fida and their Congolese church partner.

Table banking groups like Umoja Ngufu, or village savings and loan associations, are groups of 8-25 people, whose members first donate their own funds to a common pot. After that, those involved in the activity can take out loans from the accumulated fund, which are repaid with interest. Capital that would not otherwise be available to many Congolese people can be used for various purposes.

The visitors’ jaws dropped and they went speechless.

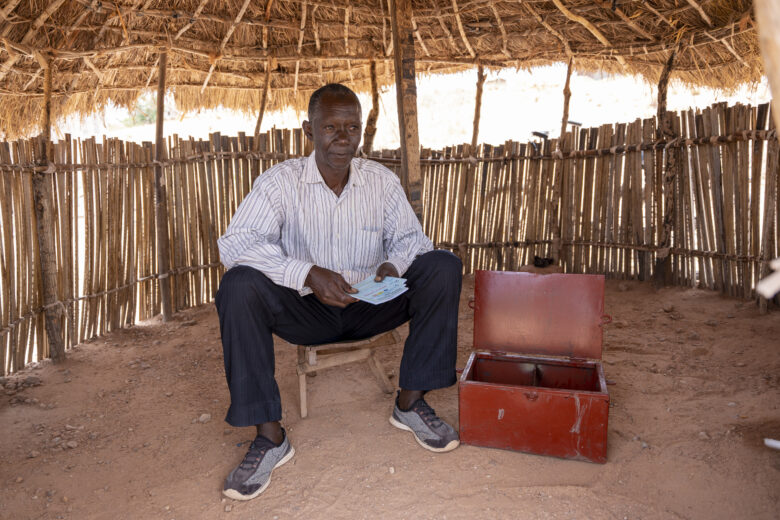

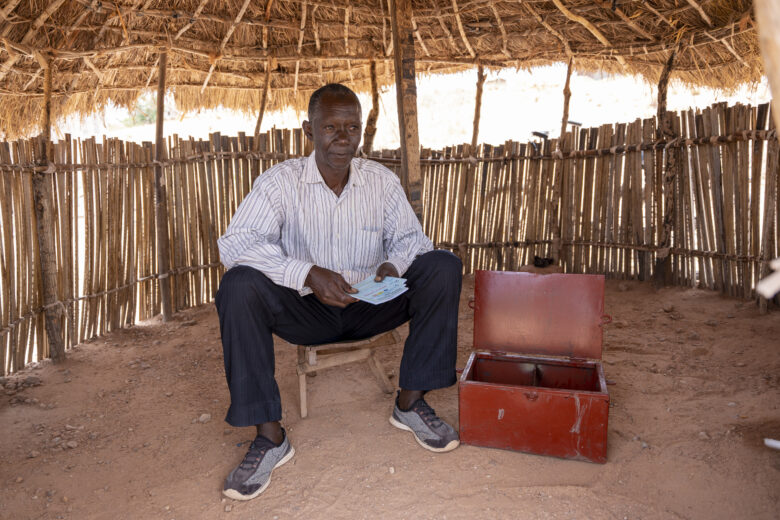

The Umoja Ngufu table bank group operates in the village of Kalenge, in the province of Tanganyika. Fida employees who came to visit the group sat on sofas and chairs in the living room of the seemingly new house. The chairman of the group, Jeanclaude, led the discussion, in which each member of the Table Banking group introduced themselves and shared their experiences.

With the loans made possible through the table bank, the members had paid their children’s school fees, started businesses and bought, for example, a radio and clean water. Birgitte was also sitting in the room, when her turn came, raised her head proudly and shared:

– I built this house with my savings from the table banking group.

The visitors’ jaws dropped and they went speechless. What a wonderful achievement!

A solution that empowers women

Fida, along with its Congolese church partner, launched table banking groups as a solution to the fact that it is impossible for many Congolese to have access to capital. Table banks offer people the opportunity to save money together and borrow it, for example, to start their own business. Business improves people’s livelihoods.

Table banking is part of Fida’s development cooperation in Congo. The activities of the groups contribute to the objectives of Finland’s development policy related to strengthening women’s rights and strengthening the role of women in the economy. [1] Table banking also promotes female entrepreneurship.

This work is a concrete way to promote gender equality.

To date, 141 table banking groups have already been established in eastern Congo. Members initially receive training in the basics of financial management, after which the group draws up rules for itself and elects a chairman, secretary, and treasurer. Women and men have equal access to table banking groups, but women make up the majority of the group’s membership.

Table banks empower women financially. Both women’s livelihoods and the economic well-being of households have improved as a result of the groups. Economically independent women are gaining a new kind of respect in their community. They will have a voice that will be listened to. Women get a say in their homes and they can walk with their heads held high. This work is a concrete way to promote gender equality.

More table banking groups on the way

One of the women who attended the Umoja Ngufu group meeting said that she was attending a table bank group meeting for the first time.

– I heard that Birgitte built her house through this group. I’m interested in hearing more about this activity, she says.

The results speak louder than words. Table banking is improving gender equality, women’s economic independence and the livelihoods of families, as it continues to spread in eastern DRC.

In the main picture, Birgitte, who built a house with a loan she received from a group of desk banks.[1] https://um.fi/suomen-kehityspolitiikan-tavoitteet-ja-periaatteet (in finnish)